Transforming Policy, Claims, and Customer Experiences with Intelligent Automation

At dotSolved, we help insurance carriers spanning life, health, property, and casualty modernize their operations, streamline customer engagement, and boost profitability with end-to-end ERP, CRM, and Agentic AI capabilities. Our cloud-first platforms and intelligent automation solutions are designed to drive agility, compliance, and customer trust.

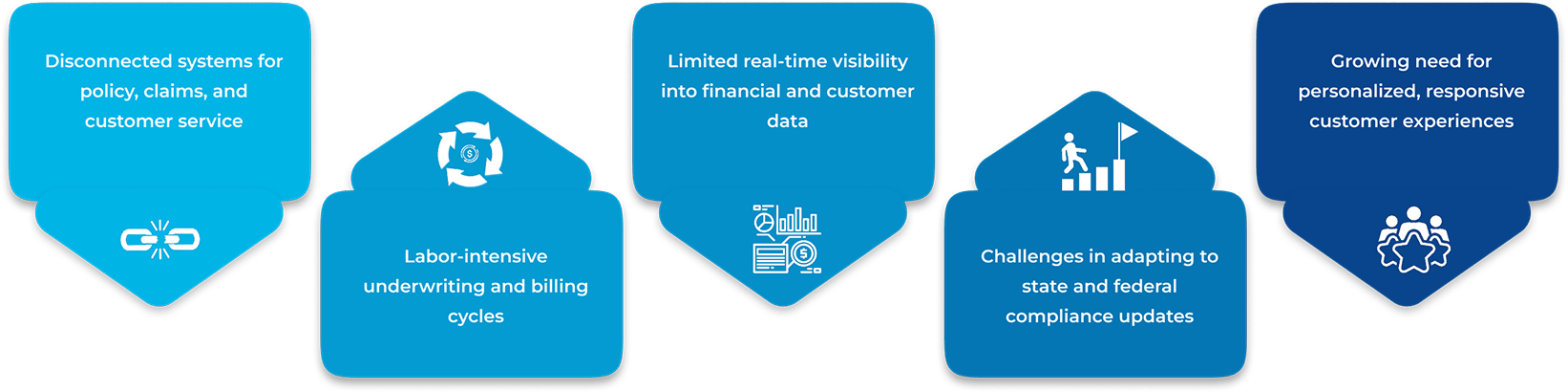

Industry Challenges We Solve

The insurance landscape is evolving rapidly with increased competition, changing customer demands,

and regulatory pressures. Common pain points we help solve:

dotSolved’s ERP, CRM & AI Advantage

We combine cloud-native platforms like Oracle NetSuite and Salesforce, with Agentic AI and Intelligent

Automation to give insurers a competitive edge.

(or)

We combine cloud-native ERP and CRM platforms, with Agentic AI and Intelligent Automation.

Unified Policy Lifecycle Management

Automate and manage policy creation, renewals, endorsements, and cancellations in a single, integrated ERP system eliminating data silos and improving efficiency.

Financial Controls & Regulatory Compliance

Maintain full visibility into finances, commissions, and regulatory metrics with automated workflows, audit trails, and customizable compliance dashboards.

Automated Claims Processing with AI

Streamline intake, triage, fraud detection, and settlement using intelligent automation and AI-assisted decisioning, reducing time and cost per claim.

Embedded Analytics & Decision Intelligence

Track claim trends, underwriting risk, and customer lifetime value using real-time analytics and predictive AI models to inform smarter decisions.

Hyper-Personalized Customer Engagement

Harness your CRM and Agentic AI to deliver dynamic, context-aware policyholder experiences across email, phone, portal, and chat.

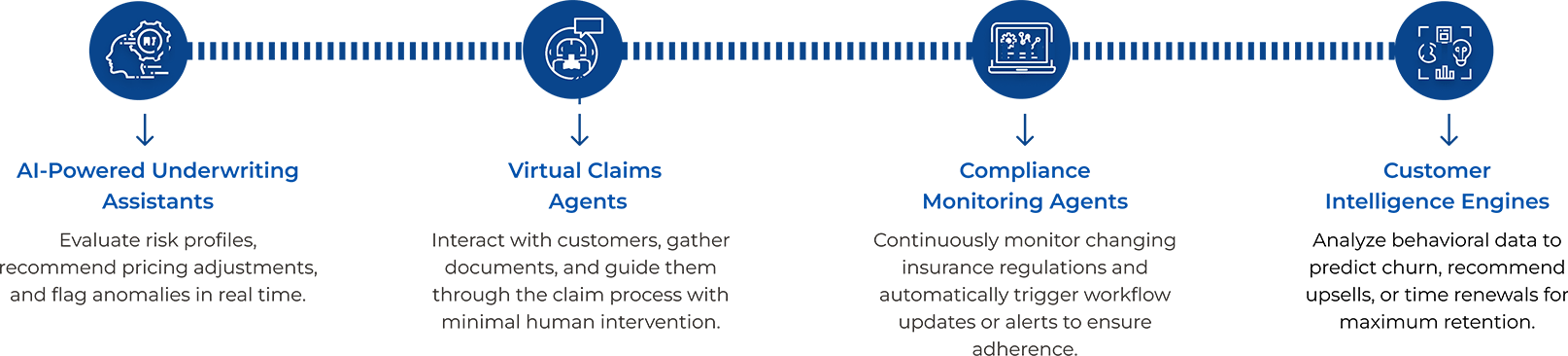

Agentic AI & Intelligent Automation for Insurance

Our Agentic AI capabilities extend beyond traditional rule-based automation. By deploying intelligent agents that can

independently analyze, decide, and act on complex insurance workflows, dotSolved enables:

This leap from automation to autonomous operations helps insurers cut costs, increase

speed, and improve accuracy while freeing up human agents for high-value tasks.

Key Capabilities We Deliver

Cloud ERP Implementation (NetSuite, Oracle Cloud)

End-to-end policy, billing, and finance management

Salesforce CRM for Insurance

360° customer visibility, marketing automation, and case management

Agentic AI & Decision Intelligence

Autonomous process handling and proactive insights

Claims Automation & Fraud Detection

Faster settlements, fewer errors, and reduced losses

Compliance-Ready Infrastructure

NAIC, HIPAA, SOC 2-aligned reporting and controls

Legacy Integration & Data Migration

Connect core systems and modernize tech stacks seamlessly

We Serve All Insurance Segments

Why dotSolved for Insurance?

Our deep experience in ERP, CRM, AI, and automation combined with domain knowledge in insurance

makes us the partner of choice for forward-thinking carriers. We offer:

Accelerate digital transformation in your insurance enterprise

Let’s explore how dotSolved can help you reduce risk, boost efficiency, and scale customer value. Schedule a consultation with our experts